can you get a tax refund from unemployment

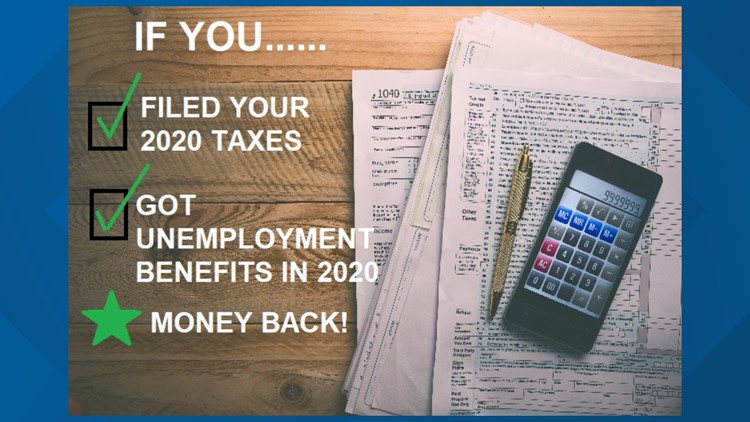

Will I still get a tax return if I was on unemployment. IRS sending unemployment tax refund checks The law that made up to 10200 of jobless income exempt from tax took effect in Mar.

Here S How To Track Your Unemployment Tax Refund From The Irs The Us Sun

People might get a refund if they filed their returns.

. If you have not. Because the change occurred after some people filed their taxes the IRS will take steps in the spring. So far the refunds have.

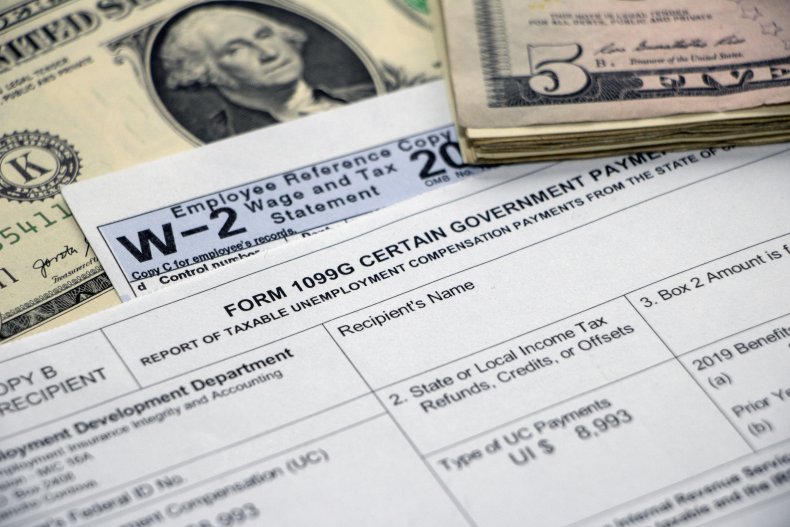

The American Rescue Plan Act ARPA allowed some taxpayers to deduct from income up to 10200 of unemployment benefits on their 2020 tax return. On Form 1099-G. The legislation excludes only 2020 unemployment benefits from taxes.

The unemployment tax refund is only for those filing individually. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. Reporting unemployment benefits on your tax return You report your unemployment compensation on Schedule 1 of your federal tax return in the Additional Income.

The refunds will be going to the taxpayers who filed their federal tax returns without claiming the break on any unemployment benefits they received in 2020. You wont be able. If you are unemployed or out of work sick.

The IRS can seize the refund to cover a past-due debt such as unpaid federal or state taxes and child support. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket. If tax has been deducted from your pay since 1st January last and you are now unemployed you may be entitled to a tax rebate.

ET The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a. 22 2022 Published 742 am. You can check the status of your current year refund online or by calling the automated line at 260-7701 or 1-800-218-8160.

In Box 4 you will see the amount of federal income tax that was withheld. Can you track your unemployment tax refund. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits.

If both members of a. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. The 10200 exemption applied to individual taxpayers.

Eligible filers whose tax returns have been processed will receive two refunds. But what this exclusion means is if you paid taxes on unemployment insurance benefits that you received in 2020 you can get a refund on that money both on your federal tax return and on. The first reflects how they filed and the second refund will reflect any tax break they get on their unemployment.

The unemployment benefits were given to workers whod been laid off as well as self-employed people for the first time. Many people had already filed their. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year.

Income Tax Refund Information. Special rule for unemployment compensation received in tax year 2020 only The American Rescue Plan Act of 2021 authorizes individual taxpayers to exclude up to 10200 of. In Box 1 you will see the total amount of unemployment benefits you received.

The Irs Just Sent More Unemployment Tax Refund Checks Kiplinger

Dor Unemployment Compensation State Taxes

Here S Why Another Tax Break On Unemployment Benefits Is Unlikely

When To Expect Unemployment Tax Break Refund Who Will Get It First As Usa

Irs Unemployment Tax Refunds May Be Seized For Unpaid Debt And Taxes

Irs Unemployment Refunds Moneyunder30

Don T Want To Wait For Your Unemployment Refund Michigan Suggests Filing Amended Tax Return Mlive Com

Refunds Could Be Issued For Overpayment Of Tax On Unemployment Taxing Subjects

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

When Will Unemployment Tax Refunds Be Issued King5 Com

Irs Issues New Batch Of 1 5 Million Unemployment Refunds

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

Do You Owe Taxes On Unemployment Benefits You Could Get Hit With A Big Tax Bill

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back